Key points:

- The UK Dividend Aristocrats Index is created by S&P and is based on a managed dividends policy of increasing or stable dividends for at least 10 consecutive years.

- In Europe, it is not common to focus on paying a dividend in a row ( consecutive years) to the shareholders.

- Only 35 UK stocks are a member of this list.

The UK Dividend Aristocrats are based (by S&P) on the 40 highest dividend-yielding UK companies within the S&P Europe Broad Market Index (BMI) and a managed dividends policy of increasing or stable dividends for at least 10 consecutive years.

Due to COVID-19 and the above-mentioned criteria, the current number of UK dividend aristocrats is only 35.

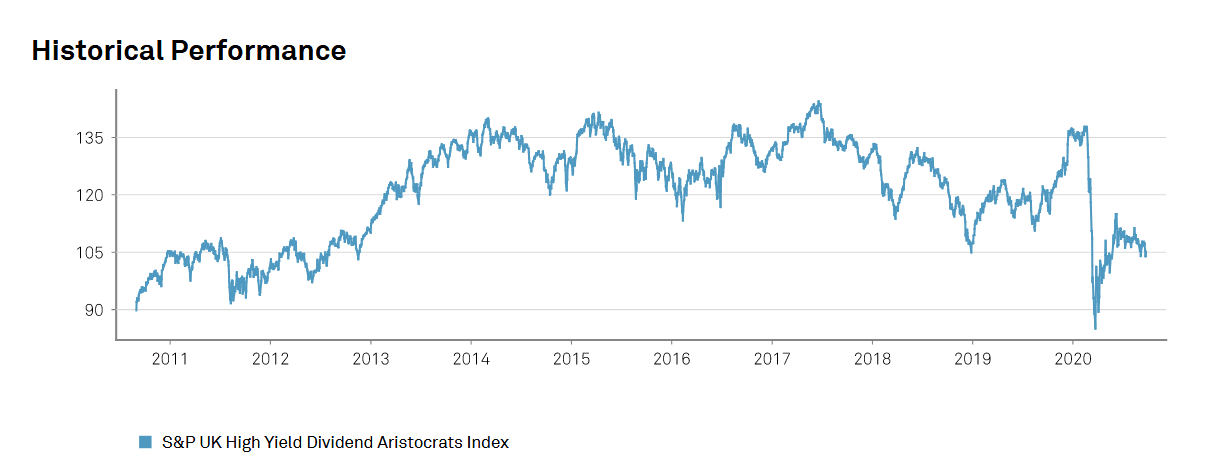

UK Aristocrats Performance 2020

In 2020, the UK Dividend Aristocrats index performance is at the moment of writing down almost 20% year-to-date. The annualized total return over 10 years is 6.08%. The indicated dividend yield is around 4.1% and the average projected PE is 14.85 for the stocks in this index.

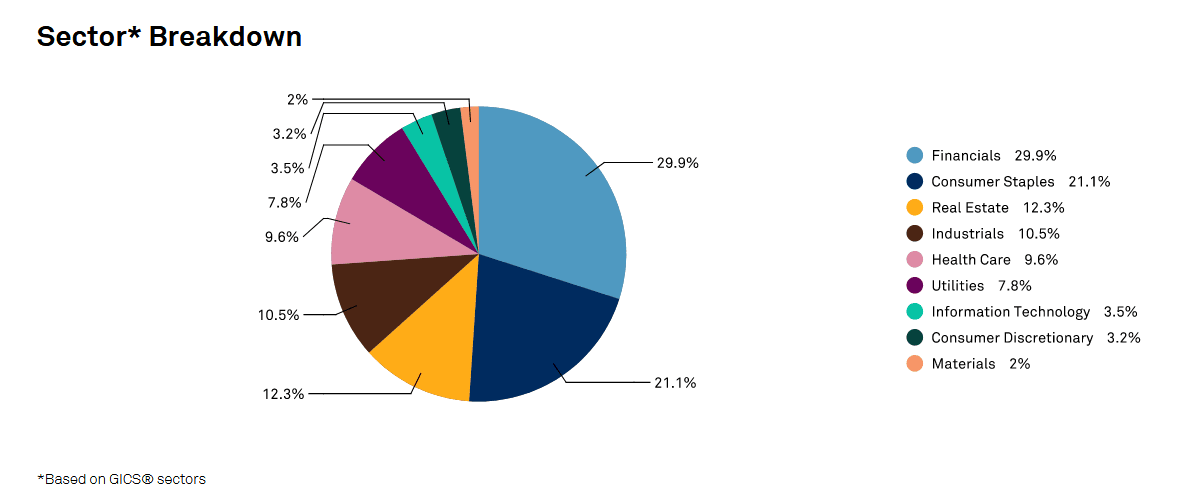

UK Dividend Aristocrats sector Breakdown

As explained the UK Dividend Aristocrats Index currently contains 35 stocks. As you can see below, the Financial sector accounts for 29.9% of the index. Materials are on the other end of the spectrum at less than 2% of the European Dividend Aristocrats Index. To compare, the largest US dividend aristocrats sector is Consumer staples.

The 10 highest Yielding UK Aristocrats

The average dividend yield for all the UK dividend aristocrats is around 4.1% at the moment of writing. Here are the 10 highest UK dividend aristocrats yields:

UK Dividend Aristocrat #10: Pennon Group Plc

Dividend Yield: 4.3%

Increased or maintained dividend: 19 years

Pennon Group PLCP is an environmental utility infrastructure company. The company provides water and wastewater services through the merged water company of South West Water and Bournemouth Water and Waste management through Viridor.

UK Dividend Aristocrat #9: Tate & Lyle Plc

Dividend Yield: 4.4%

Increased or maintained dividend: 10 years

Tate & Lyle PLC provides ingredients and solutions to the food, beverage, and other industries. Its products include dairy, beverage, bakery and convenience, sweeteners, and starches. Its segments are Speciality Food Ingredients and Bulk Ingredients.

UK Dividend Aristocrat #8: Ashmore Group Plc

Dividend Yield: 4.8%

Increased or maintained dividend: 10 years

Ashmore Group PLC is engaged in the provision of investment management services. The Company is a fund manager across investment themes, such as external debt, local currencies, corporate debt, blended debt, alternatives and others.

UK Dividend Aristocrat #7: United Utilities Group Plc

Dividend Yield: 5.1%

Increased or maintained dividend: 10 years

United Utilities Group PLC is engaged in utility operations. The company, through its subsidiaries, owns and manages a regulated water and wastewater network.

UK Dividend Aristocrat #6: GlaxoSmithKline Plc

Dividend Yield: 5.1%

Increased or maintained dividend: 10 years

GlaxoSmithKline PLC creates, discovers, develops, manufactures and markets pharmaceutical products including respiratory and antiviral, vaccines, over-the-counter (OTC) medicines and health-related consumer products.

UK Dividend Aristocrat #5: TP ICAP Plc

Dividend Yield: 5.9%

Increased or maintained dividend: 10 years

TP ICap PLC provides broking professional intermediary services to match buyers and sellers of different financial, energy and commodities products. Its client include banks, insurance companies, pension funds, asset managers and hedge fund among others.

UK Dividend Aristocrat #4: Phoenix Group Holdings Plc

Dividend Yield: 7.0%

Increased or maintained dividend: 10 years

Phoenix Group Holdings is a specialist closed life and pension fund consolidator. It manages closed life funds by protecting and enhancing policyholders’ interests.

UK Dividend Aristocrat #3: British American Tobacco Plc (BAT)

Dividend Yield: 7.7%

Increased or maintained dividend: 24 years

British American Tobacco PLC manufactures and sells cigarettes and other tobacco products under the brands Dunhill, Kent, Lucky Strike, Pall Mall and Rothmans. It also offers Vapour Products, like e-cigarettes, and Tobacco Heating Products.

UK Dividend Aristocrat #2: Jupiter Fund Management Plc

Dividend Yield: 8.4%

Increased or maintained dividend: 10 years

Jupiter Fund Management PLC is a fund manager, engaged in managing equity investments on behalf of retail, institutional and private client investors across products, including the UK and offshore mutual funds, segregated mandates, and investment trusts.

UK Dividend Aristocrat #1: Legal & General Group Plc

Dividend Yield: 9.9%

Increased or maintained dividend: 12 years

Legal & General Group PLC sells insurance products and other financial services. It transacts life assurance and longterm savings business, investment management and general insurance and health business.

Other Sources of Dividend Investment Ideas

There are several lists to quickly screen for businesses that regularly pay rising dividends.

- The Dividend Aristocrats Index is based on 64 companies part of the S&P 500 and with 25+ years of consecutive dividend increases.

- The Dividend Kings List is even more exclusive than the Dividend Aristocrats. It is comprised of less than 20 businesses with 50+ years of consecutive dividend increases.

- The MoneyInvestExpert Defensive Aristocrats is a performance-based top-10 selection of the Dividend Aristocrats to outperform the market in the long-term.

- Portfolio lists like the Berkshire Hathaway Portfolio or Bill Gates’stock portfolio can be a source.

- For the European focused investors, there is also the list of European Dividend Aristocrats.

- Dividend Champions are not necessarily members of the S&P 500 index, have increased their dividend for 25 or more consecutive years.

- 100+ years of dividend, the list of stocks that pay over 100 years of dividend can be a list of inspiration.

- Blue Chips stocks from the US or the European ones.

Next to selecting the right dividend stocks, important principles for successful long-term investing are Disciple, Diversification, Defensive & indeed Dividend. Read more about this in our free e-book.

Thanks for reading this article.

Please send any feedback, corrections, or questions to service[@]moneyinvestexpert.com.