The Dogs of The Dow is an investing strategy that consists of buying the 10 stocks with the highest dividend yield out of the Dow Jones Industrial Average (DJIA), an index of 30 large-cap U.S. stocks. The portfolio should be adjusted at the beginning of each year to include the 10 highest yielding stocks. It’s important to note that this is a long-term investment strategy. In the long run, the average return of the Dogs should outperform the Dow-30.

A simple dividend strategy

To implement the Dog of the Dow strategy is simple, just take the amount of money you would like to invest in this strategy and then divide this equally over the 10 highest yielding stocks in the DJIA. Hold these stocks for a year and then at the end of 12 months, look at the 30 Dow stocks again and apply again the 10 highest yielding stocks rule.

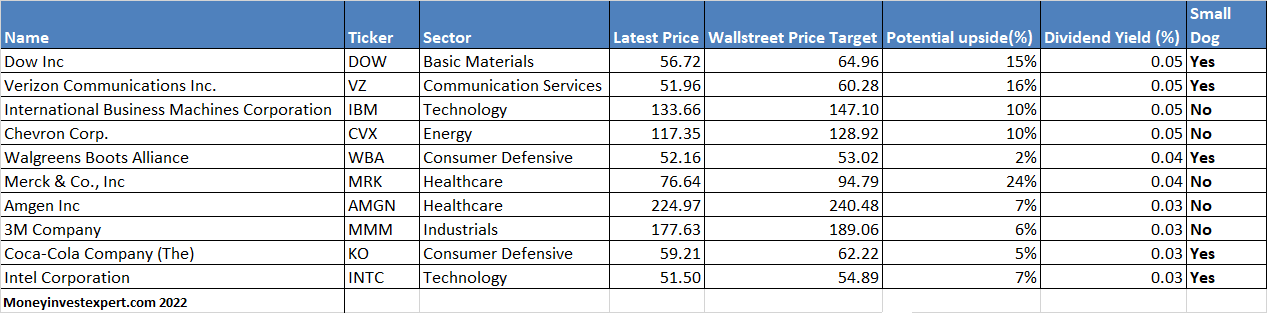

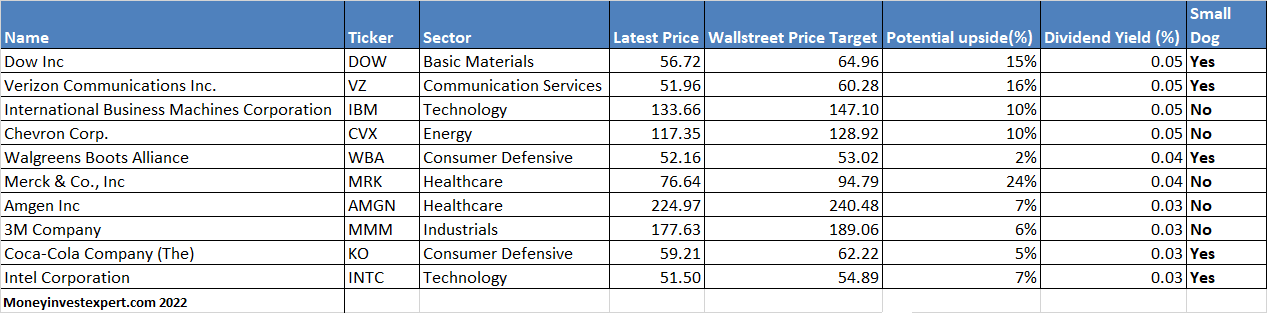

Here are the dogs of the Dow for 2022, including the close price of 12/31/21 and upside potential based on the Wallstreet price target (1 year):

Members can use this screener to check the latest data.

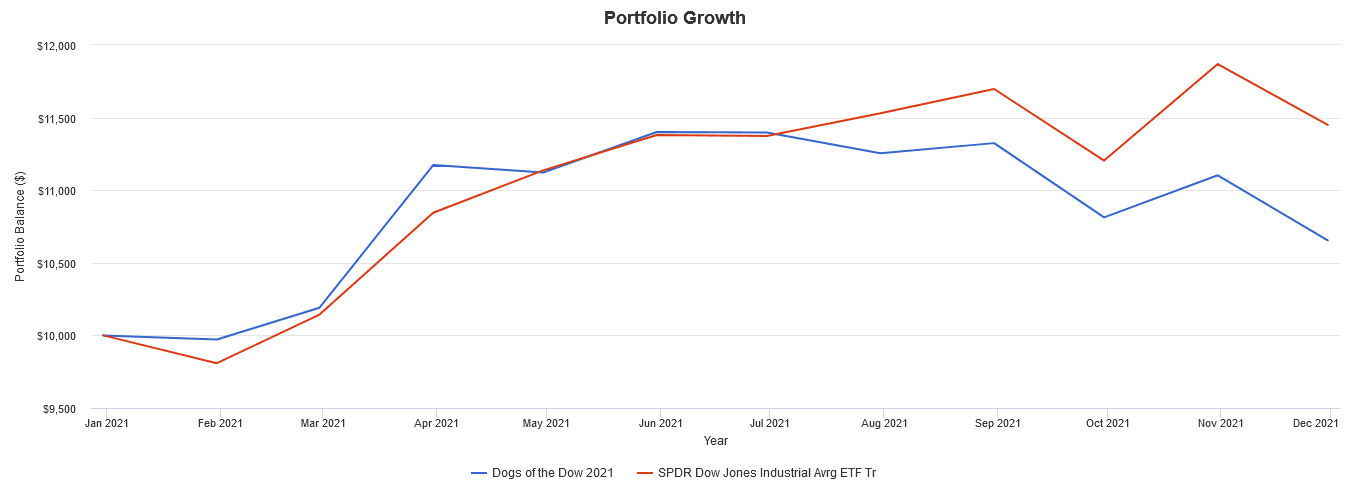

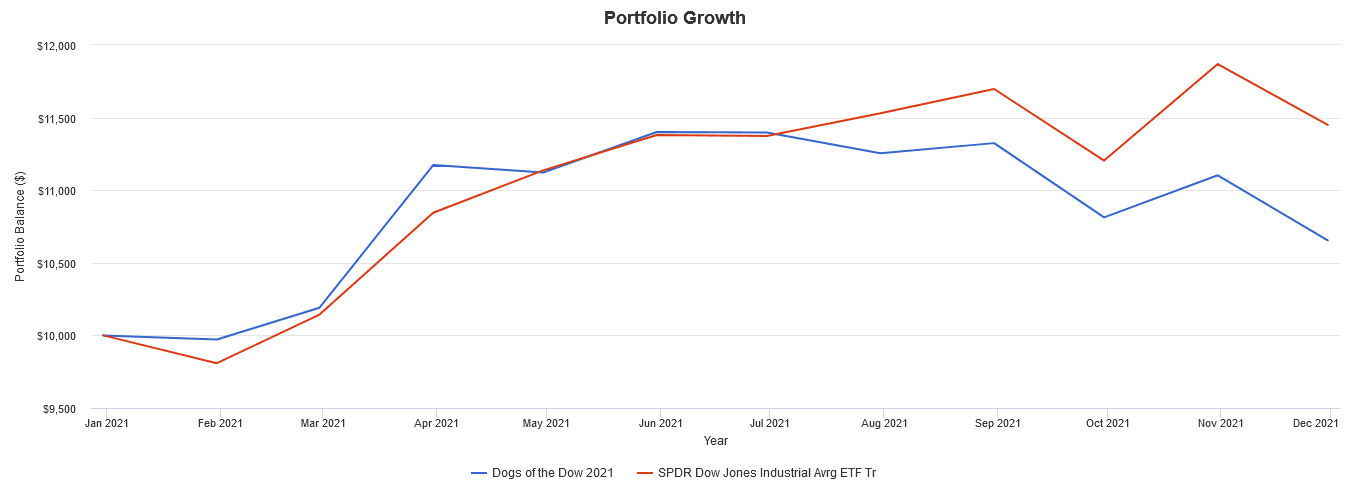

Dogs of the Dow Performance 2021

Despite the ongoing COVID-19 pandemic, the (high) inflation fears, the Dow Jones Index (DJI) is up +14.49% for the year and the S&P 500 gained even more.

In 2021, the Dogs of the Dow strategy underperformed both the S&P 500 and DJI. The 10 Dogs of the Dow ended 2021 with a performance of 6.55%. which is far below the DJI (DJI).

In 2021, the Dogs of the Dow strategy underperformed both the S&P 500 and DJI. The 10 Dogs of the Dow ended 2021 with a performance of 6.55%. which is far below the DJI (DJI).

The underperformance is mainly the result of the allocation to Verizon, Amgen, and Coca-Cola.

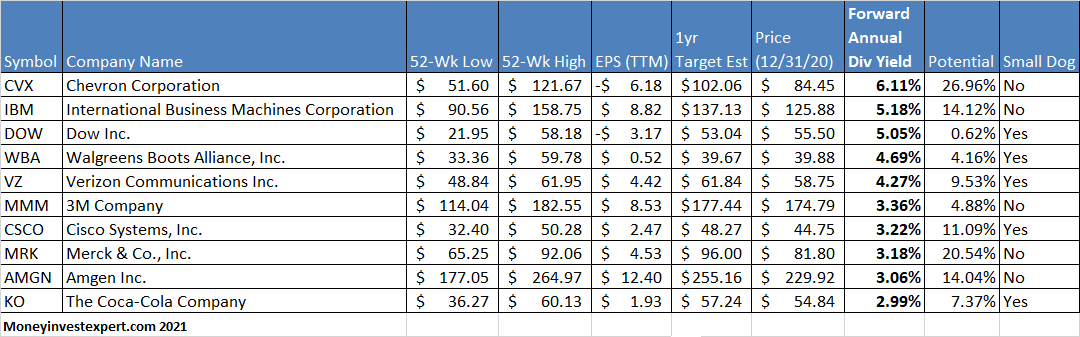

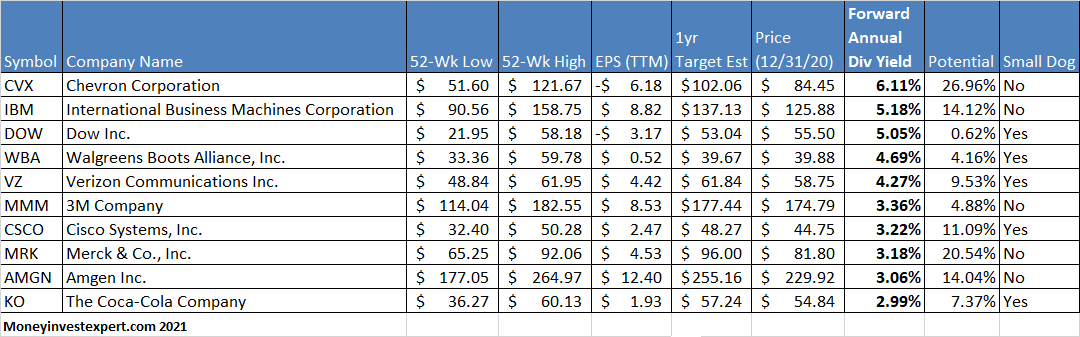

For your reference, below are the Dogs of the Dow 2021 and their 12/31/20 dividend yield:

Compared to 2020, Exxon and Pfizer will be replaced by Amgen (AMGN) and Merck & Co (MRK).

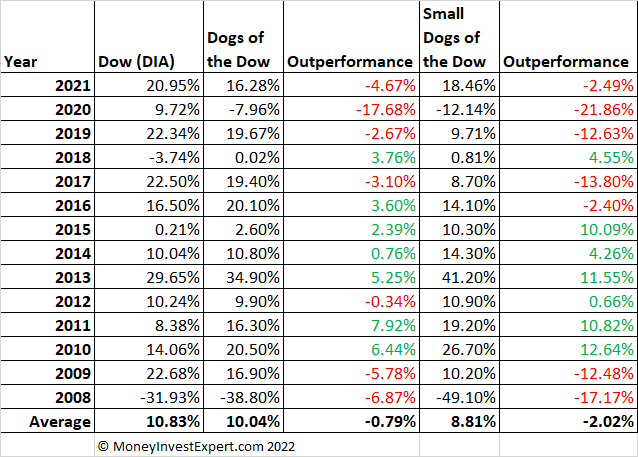

Is the Dogs Strategy still working?

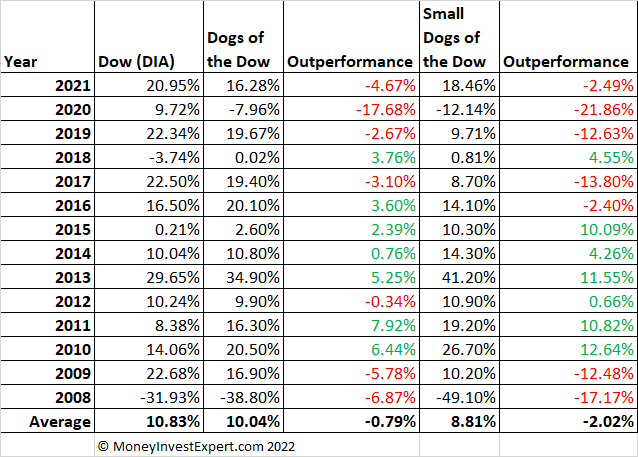

Looking back over a longer period of time (2008-2021), the average annual return of the DJIA was 10.05% versus 9.56% for the Dogs of the Dow strategy. The Small Dogs of the Dow are over time slightly worse with an average annual return of 8.07%. The out-performance in percentages is -0.49% for the general Dogs strategy and -1.98% for the small dogs. Both strategies outperform 7 out of the last 13 years.

One should keep in mind with this investment strategy that the Dow stocks with the highest yields likely did not perform well in the past year are selected. (As prices go up, yields go down, and vice versa.). So, in many cases, the (2020) laggards are selected. 2020 has been an exceptional year and impacting the outperformance a lot as you can see in the table below.

Final Thoughts

Some closing thoughts, dividend stocks, and the Dogs of the Dow strategy is an interesting starting point for dividend investors. However, this popular investment strategy that prioritizes high dividend yields is struggling to keep up with the Dow Jones Index and outperform the index. Since 2008 the average outperformance is even negative. Being optimistic for 2022, the upward potential is still looking okayish.