- S&P Europe 350® Dividend Aristocrats® measure the performance of S&P Europe 350 constituents that have followed a policy of consistently increasing dividends every year for at least 10 consecutive years.

- The index benchmark is the S&P Europe 350 index

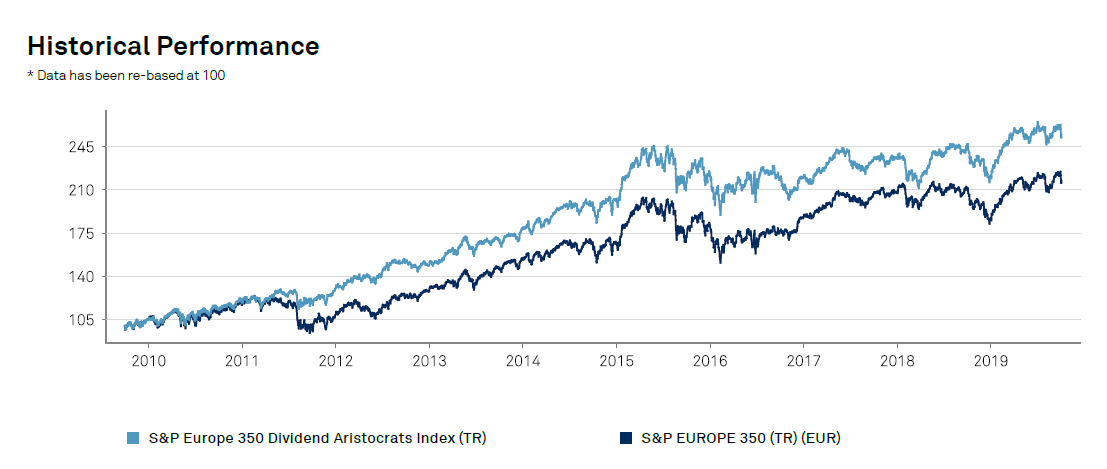

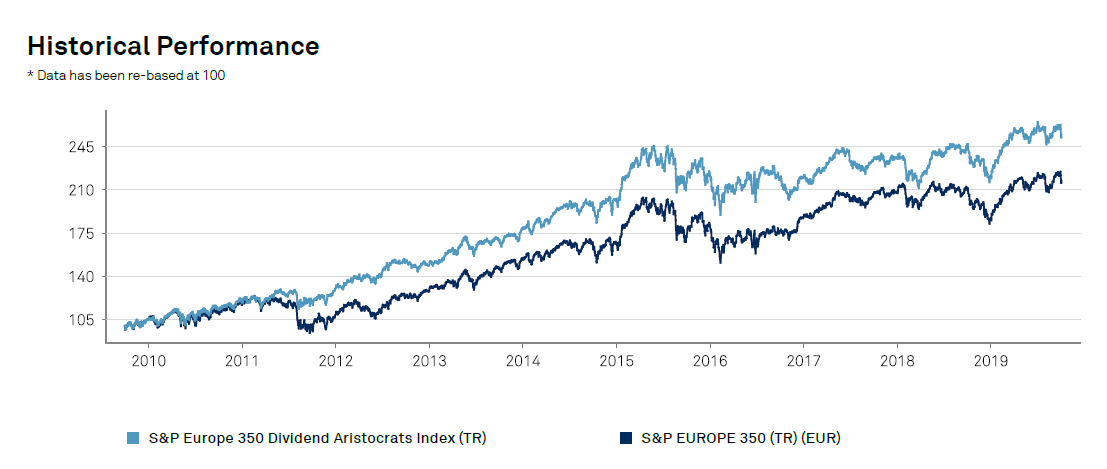

- Like the (US) Dividend Aristocrats “big brother”, the European Dividend Aristocrats also tend to outperform its benchmark, lower volatility, and annual risk.

- By showing the recent performance of the European Dividend Aristocrats, some active dividend growth investors may be able to identify potential bargains.

European equities kept a positive momentum in October and ended in positive territory, despite concerns about slowing economic growth in the Eurozone and continued Brexit uncertainty. The S&P Europe 350 gained 1.1% in October after 2.63% in September. The index is even on its way to one of the best years since 2009 and up 21.31% year-to-date.

The European Dividend Aristocrats index total return was up 1.12% for October 2019. Based on the YTD total return of 19.78%, versus 21.31% for the benchmark, the European Dividend Aristocrats are still showing a small underperformance this month. However, in the long-run, the outperformance is still significant with 10.38% versus 8.76%, annualized returns over a ten years period.

European dividend aristocrats performance

European dividend aristocrats performance

The table below lists all European Dividend Aristocrats companies sorted descending by dividend yield and lists closing price per end of the month (10/31/2019), dividend yield.

Coloplast (COLO-B.CO) and Novo Nordisk (NOVO-B.CO), both from Denmark are the best performing European dividend stocks of this list (in local currency). British American Tobacco (BATS) lost -9.41% in October, the stock plunged on profit warning as the U.S. vaping crisis deepens and more or less following Imperial Brands (IMB)in this crisis. (see the article on IMB crisis )

Enagas, SSE PLC and Micro Focus are still the top dividend-yielders. However, Micro Focus tumbled 30% in August after slashing sales outlook, recovered somewhat in September but down again in October.

Other Sources of Dividend Investment Ideas

The Dividend Aristocrats list is not the only way to quickly screen for businesses that regularly pay rising dividends.

- The Dividend Kings List is even more exclusive than the Dividend Aristocrats. It is comprised of less than 20 businesses with 50+ years of consecutive dividend increases.

- The MoneyInvestExpert Defensive Aristocrats is a performance-based top-10 selection of the Dividend Aristocrats to outperform the market on the long-term.

- Portfolio lists like the Berkshire Hathaway Portfolio or Bill Gates’stock portfolio can be a source.

- For the European focused investors there is also the list of European Dividend Aristocrats.

- Dividend Champions are not necessarily members of the S&P 500 index, have increased their dividend for 25 or more consecutive years.

- 100+ years of dividend, the list of stocks that pay over 100 year of dividend can be an list of inspiration.

Next to selecting the right dividend stocks, important principles for successful long-term investing are Disciple, Diversification, Defensive & indeed Dividend. Read more about this in our free e-book.

Thanks for reading this article.

Please send any feedback, corrections, or questions to service[@]moneyinvestexpert.com.